ProfMiniDayTrader

ProfMiniDayTrader's Price Action Day Trading System for Eminis: ES, NQ, and YM

Cross-Column Pages

Search This Blog

Monday, January 18, 2016

Google Is Going To Require Readers to Have A Google Account To Sign Into Friend Connect And Follow Blogs

The latest from Blogger Buzz An update on Google Friend Connect 4 weeks ago by A Googler In 2011, we announced the retirement of Google Friend Connect for all non-Blogger sites. We made an exception for Blogger to give readers an easy way to follow blogs using a variety of accounts. Yet over time, we’ve seen that most people sign into Friend Connect with a Google Account. So, in an effort to streamline, in the next few weeks we’ll be making some changes that will eventually require readers to have a Google Account to sign into Friend Connect and follow blogs.

Tuesday, September 25, 2012

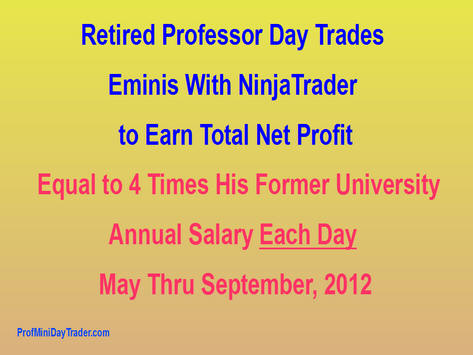

Prof Shows His Outstanding Net Profits Trading E-Minis May-Sep 2012

|

| Click on this slide to view a 15-slide summary of the 5-month trial |

Retired Prof Day Trades Eminis with NinjaTrader to average net profit of $400,000 each day May thru September, 2012. I am that Retired Professor. Over the past two years, I developed my personal trading system by selecting and optimizing indicators that help me make the best trades as the market moves. Each day is different, so I designed a system of utilizing multiple confirming signals which help me anticipate entry and exit prices for my trades. My system made consistently profitable trades, day after day, with a wide variety of market conditions. I started my latest trial trading live data in May 2012. A new simulation account was funded with $15,000 on each of two different computers. I traded all the time the market was open to get experience with trade management while coping with a wide variety of market conditions. Another goal was to trade aggressively to see if I could get the accounts to increase at a rapid rate. As the accounts grew, I reasoned that it would be good to gain experience with managing large accounts.

I had extraordinary results and kept surpassing and raising my goals. After 5 months of consistent winning trading days, my overall average earnings for the entire 5 months were equal to 4 times my former annual salary each calendar day.

Most months average of 20 trading days per month. I did not trade for 20 days during the 5-month trial period because I took some vacation days. After all, I am retired!

“Show me your Equity Curves, if you have such a good system!” That is what I was always thinking when I heard a Guru spouting off in a seminar or webinar about how great their trading system performed.

You can view the details of how I conducted a 5-month trial in which I traded live market data in two separate accounts in NinjaTrader on different computers. The average calendar daily Net Profit (before commissions and fees) for my trading system from May 7 to September 21, 2012 was $188,119 per day for the Inspiron computer account and $223,392 per day for the Vostro computer. Combining the Total Net Profits for both accounts for the entire 5-month trial period equals $411,511 for EACH CALENDAR DAY. That amount is approximately 4.0 times my 2007 ANNUAL salary as a full-time university professor. I was with the same employer for 32 years.

Click on the Prof below to view the Day by Day numbers for the entire 5-month trial of his trading system.

(Least viewing problems if you are logged into your gmail account with Google)

|

| Click on the Prof to view Day by Day numbers for 5-month trial |

Trading With Your Eyes On The Road

Prof’s opinion is that selecting certain indicators to guide your trading, is not going to automatically make you a better trader. So far, I have not found any indicator that I consider to be the “Holy Grail.”

Do you drive your car by only looking in the rear view mirror? This would be dangerous, especially if you are driving at night. Would you be likely to have an accident by crashing into something? Ladies and gentlemen, I have often read estimates that 90 to 95% of the small traders lose their accounts. This is why many trading websites have this warning: “Past Performance is not necessarily indicative of future results.”

Small traders who lose money usually drive their trading by looking at indicators that are not responsive directly to the current market price. We advocate keeping your eyes on the road when you are driving your car (analogy=trading). You will have fewer accidents by heeding signs: curve ahead, speed limit, rough road, road closed, etc. You need to be aware of what other drivers in front of you, behind you, or beside you are doing. By being a safe driver you will not lose your car or possibly your life (analogy = trading account)

You can even have a safer trip if you use a GPS (analogy = alerting indicators to trade) to automatically tell you that you need to make a turn soon, there is a curve (analogy = swing trade) or a rough road ahead (analogy = “chop”, prices are moving sideways) , or that you have reached an exit off the interstate (analogy = reached your profit target or stop loss).

When driving you can reach your destination by alternate routes. Our trading scheme is designed to adjust trades so that you can enhance your chances of exiting the overall trade with a profit. You have to see the profminidaytrading system live to appreciate how it works. Our training program is designed to teach you to perform live trades in your own simulation account with our guidance. Performing live trades for several consecutive weeks whenever the setup point is reached will increase your confidence to make trades. Within a few weeks you will know when you are ready to trade with real money. The proof will be that you have successfully created a positive equity curve doing live trades in your simulated trading account.

Profminidaytrader’s training in trading will equip you to trade with a GPS so you can navigate to places you have never seen before. You will learn to enter or exit a trade based on the information you interpret on the right edge of your screen. Just as you can drive your car anywhere, once you learn how to drive safely, Profminidaytrader’s training will equip you to day trade E-mini Futures whenever you want to, and to be able to cope with changing market conditions whenever they occur.

If you can find a trading performance record that is better than Profminidaytrader’s anywhere on the internet, Email the link to profminidaytrading@gmail.com and we will reward you with one month of FREE access to our live trading room.

If you can find a trading performance record that is better than Profminidaytrader’s anywhere on the internet, Email the link to profminidaytrading@gmail.com and we will reward you with one month of FREE access to our live trading room.

Thank you for viewing and listening to this presentation.

Drive and Trade safely.

Prof

The 5 Steps to Becoming a Trader

Step One: Unconscious Incompetence

This is the first step you take when starting to look into trading. you know that its a good way of making money because you've heard so many things about it and heard of so many millionaires. Unfortunately, just like when you first desire to drive a car you think it will be easy - after all, how hard can it be? Price either moves up or down - what's the big secret to that then - let's get cracking!

Unfortunately, just as when you first take your place in front of a steering wheel you find very quickly that you haven't got the first clue about what you're trying to do. You take lots of trades and lots of risks. When you enter a trade it turns against you so you reverse and it turns again… and again, and again.

You may have initial success, and that's even worse - because it tells your brain that this really is simple and you start to risk more money.

You try to turn around your losses by doubling up every time you trade. Sometimes you'll get away with it but more often than not you will come away scathed and bruised You are totally oblivious to your incompetence at trading.

This step can last for a week or two of trading but the market is usually swift and you move onto the next stage.

Step Two - Conscious Incompetence

Step two is where you realize that there is more work involved in trading and that you might actually have to work a few things out. You consciously realize that you are an incompetent trader - you don't have the skills or the insight to turn a regular profit.

You now set about buying systems and e-books galore, read websites based everywhere from USA to the Ukraine. and begin your search for the holy grail. During this time you will be a system nomad - you will flick from method to method day by day and week by week never sticking with one long enough to actually see if it does work. Every time you come upon a new indicator you'll be ecstatic that this is the one that will make all the difference.

You will test out automated systems on Metatrader, you'll play with moving averages, Fibonacci lines, support & resistance, Pivots, Fractals, Divergence, DMI, ADX, and a hundred other things all in the vain hope that your 'magic system' starts today. You'll be a top and bottom picker, trying to find the exact point of reversal with your indicators and you'll find yourself chasing losing trades and even adding to them because you are so sure you are right.

You'll go into the live chat room and see other traders making pips and you want to know why it's not you - you'll ask a million questions, some of which are so dumb that looking back you feel a bit silly. You'll then reach the point where you think all the ones who are calling pips after pips are liars - they can't be making that amount because you've studied and you don't make that, you know as much as they do and they must be lying. But they're in there day after day and their account just grows whilst yours falls.

You will be like a teenager - the traders that make money will freely give you advice but you're stubborn and think that you know best - you take no notice and overtrade your account even though everyone says you are mad to - but you know better. You'll consider following the calls that others make but even then it won't work so you try paying for signals from someone else - they don't work for you either.

You might even approach a 'guru' like Rob Booker or someone on a chat board who promises to make you into a trader(usually for a fee of course). Whether the guru is good or not you won't win because there is no replacement for screen time and you still think you know best.

This step can last ages and ages - in fact in reality talking with other traders as well as personal experience confirms that it can easily last well over a year and more nearer 3 years. This is also the step when you are most likely to give up through sheer frustration.

Around 60% of new traders die out in the first 3 months - they give up and this is good - think about it - if trading was easy we would all be millionaires. another 20% keep going for a year and then in desperation take risks guaranteed to blow their account which of course it does.

What may surprise you is that of the remaining 20% all of them will last around 3 years - and they will think they are safe in the water - but even at 3 years only a further 5-10% will continue and go on to actually make money consistently.

By the way - they are real figures, not just some I've picked out of my head - so when you get to 3 years in the game don't think its plain sailing from there.

I have had many people argue with me about these timescales - funny enough none of them have been trading for more than 3 years - if you think you know better then ask on a board for someone who's been trading 5 years and ask them how long it takes to become fully 100% proficient. Sure I guess there will be exceptions to the rule - but I haven't met any yet.

Eventually you do begin to come out of this phase. You've probably committed more time and money than you ever thought you would, lost 2 or 3 loaded accounts and all but given up maybe 3 or 4 times but now its in your blood

One day - in a split second moment you will enter stage 3.

Step 3 - The Eureka Moment

Towards the end of stage two you begin to realize that it's not the system that is making the difference. You realize that its actually possible to make money with a simple moving average and nothing else IF you can get your head and money management right You start to read books on the psychology of trading and identify with the characters portrayed in those books and finally comes the eureka moment.

The eureka moment causes a new connection to be made in your brain. You suddenly realize that neither you, nor anyone else can accurately predict what the market will do in the next ten seconds, never mind the next 20 minutes.

Because of this revelation you stop taking any notice of what anyone thinks - what this news item will do, and what that event will do to the markets. You become an individual with your own method of trading

You start to work just one system that you mold to your own way of trading, you're starting to get happy and you define your risk threshold.

You start to take every trade that your 'edge' shows has a good probability of winning with. When the trade turns bad you don't get angry or even because you know in your head that as you couldn't possibly predict it isn't your fault - as soon as you realize that the trade is bad you close it . The next trade or the one after it or the one after that will have higher odds of success because you know your system works.

You stop looking at trading results from a trade-to-trade perspective and start to look at weekly figures knowing that one bad trade does not a poor system make.

You have realized in an instant that the trading game is about one thing - consistency of your 'edge' and your discipline to take all the trades no matter what as you know the probabilities stack in your favor.

You learn about proper money management and leverage - risk of account etc etc - and this time it actually soaks in and you think back to those who advised the same thing a year ago with a smile. You weren't ready then, but you are now. The eureka moment came the moment that you truly accepted that you cannot predict the market.

Step 4 - Conscious Competence

You are making trades whenever your system tells you to. You take losses just as easily as you take wins You now let your winners run to their conclusion fully accepting the risk and knowing that your system makes more money than it loses and when you're on a loser you close it swiftly with little pain to your account

You are now at a point where you break even most of the time - day in day out, you will have weeks where you make 100 pips and weeks where you lose 100 pips - generally you are breaking even and not losing money. You are now conscious of the fact that you are making calls that are generally good and you are getting respect from other traders as you chat the day away. You still have to work at it and think about your trades but as this continues you begin to make more money than you lose consistently.

You'll start the day on a 20 pip win, take a 35 pip loss and have no feelings that you've given those pips back because you know that it will come back again. You will now begin to make consistent pips week in and week out 25 pips one week, 50 the next and so on.

This lasts about 6 months

Step Five - Unconscious Competence

Now we're cooking - just like driving a car, every day you get in your seat and trade - you do everything now on an unconscious level. You are running on autopilot. You start to pick the really big trades and getting 200 pips in a day doesn't make you any more excited that getting 1 pip.

You see the newbie's in the forum shouting 'go dollar go' as if they are urging on a horse to win in the grand national and you see yourself - but many years ago now.

This is trading utopia - you have mastered your emotions and you are now a trader with a rapidly growing account.

You're a star in the trading chat room and people listen to what you say. You recognize yourself in their questions from about two years ago. You pass on your advice but you know most of it is futile because they're teenagers - some of them will get to where you are - some will do it fast and others will be slower - literally dozens and dozens will never get past stage two, but a few will.

Trading is no longer exciting - in fact it's probably boring you to bits - like everything in life when you get good at it or do it for your job - it gets boring - you're doing your job and that's that.

Finally you grow out of the chat rooms and find a few choice people who you converse with about the markets without being influenced at all.

All the time you are honing your methods to extract the maximum profit from the market without increasing risk. Your method of trading doesn't change - it just gets better - you now have what women call 'intuition'

You can now say with your head held high "I'm a currency trader" but to be honest you don't even bother telling anyone - it's a job like any other.

I hope you've enjoyed reading this journey into a trader’s mind and that hopefully you've identified with some points in here.

Remember that only 5% will actually make it - but the reason for that isn't ability, its staying power and the ability to change your perceptions and paradigms as new information comes available.

The losers are those who wanted to 'get rich quick' but approached the market and within 6 months put on a pair of blinkers so they couldn't see the obvious - a kind of "this is the way I see it and that's that" scenario - refusing to assimilate new information that changes that perception.

I'm happy to tell you that the reason I started trading was because of the 'get rich quick' mindset. Just that now I see it as 'get rich slow'

If you're thinking about giving up I have one piece of advice for you.

Ask yourself the question "how many years would you go to college if you knew for a fact that there was a million dollars a year job at the end of it?

Take care and good trading to you all.

# # #

Anonymous

Subscribe to:

Posts (Atom)