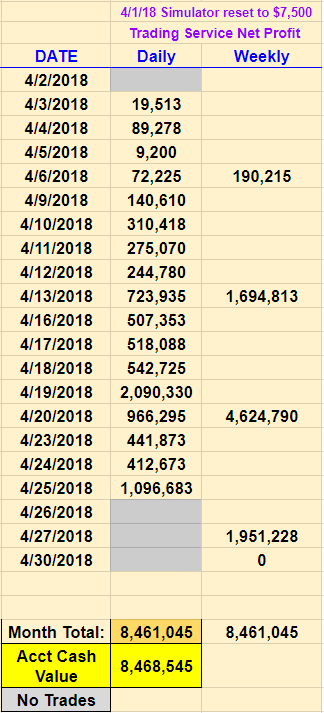

PMDT EMini Price Action Strategy- April, 2018

Each month the Simulator Account is reset to $7,500

Each month the Simulator Account is reset to $7,500

traded by small traders and have the lowest cost E-mini margins.

$458,065 (5.4 %)

April 2018 Cumulative Profit - Cost of Trades =

$8,461,045 - $458,065 = $8,002,980

==================================================

PMDT EMini Price Action Strategy- Mar 2018

Each month the Simulator Account is reset to $7,500

Cost of 121,197 trades at $5 per Round Trip =

$605,985 (12.5 %)

$605,985 (12.5 %)

March 2018 Cumulative Profit - Cost of Trades =

$4,891,407 - $605,985 = $4,255,422

==================================================

PMDT EMini Price Action Strategy- Feb 2018

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

traded by small traders and have the lowest cost E-mini margins.

Cost of 50,535 trades at $5 per Round Trip = $252,675 (7.5 %)

Jan 2018 Cumulative Profit - Cost of Trades =

$3,381,115 - $252,265 = $3,128,850==================================================

PMDT EMini Price Action Strategy- Jan 2018

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

traded by small traders and have the lowest cost E-mini margins.

Cost of 1,503 trades at $5 per Round Trip = $7,515 (11.3 %)

Jan 2018 Cumulative Profit - Cost of Trades =

$66,237 - $7,515 = $58,722

==================================================

PMDT EMini Price Action Strategy- Dec 2017

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

==================================================

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

traded by small traders and have the lowest cost E-mini margins.

Cost of 1,503 trades at $5 per Round Trip = $7,515 (11.3 %)

Jan 2018 Cumulative Profit - Cost of Trades

= 66,237 - $7,515 = $58,722

==================================================

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

traded by small traders and have the lowest cost E-mini margins.

Cost of 5,946 trades at $5 per Round Trip = $29,730 (17.0 %)

Cumulative Profit - Cost of Trades

= 175,375 - 29,730 = $145,645

==================================================

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

traded by small traders and have the lowest cost E-mini margins.

Cost of 9,960 trades at $5 per Round Trip = $49,800 (18.1 %)

Cumulative Profit - Cost of Trades

= 275,740 - 49,980 = $225,940

==================================================

PMDT EMini Price Action Strategy- Aug 2017

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

traded by small traders and have the lowest cost E-mini margins.

Cost of 7,065 trades at $5 per Round Trip = $35,325 (13.0 %)

Cumulative Profit - Cost of Trades

= 271,060 - 35,325 = $235,735

==================================================

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

traded by small traders and have the lowest cost E-mini margins.

Cost of 3,150 trades at $5 per Round Trip

= $15,750 (16.1 %)

Cumulative Profit - Cost of Trades

= 97,721 - 15,750 = $81,971

==================================================

PMDT EMini Price Action Strategy- Jun 2017

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

Cost of 20,829 trades at $5 per Round Trip

= $104,145 (12.1 %)

Cumulative Profit - Cost of Trades

= $860,004 - $104,145 = $755,859

==================================================

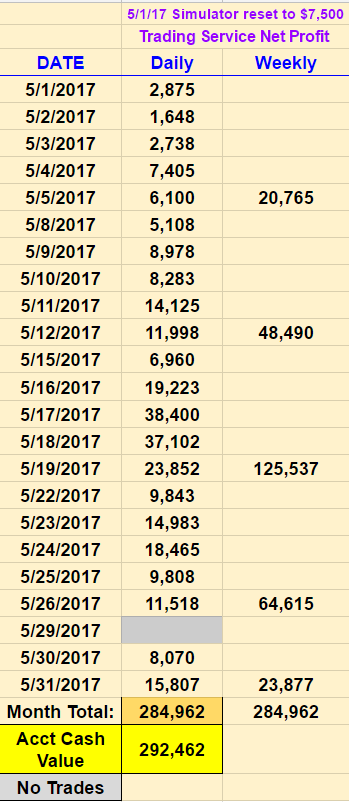

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly traded by small traders and have the lowest cost E-mini margins.

Cost of 8,261 trades at $5 per Round Trip

= $41,305 (14.5 %)

Cumulative Profit - Cost of Trades =

$284,962 - $41,305 = $243,657

==================================================

PMDT EMini Price Action Strategy- Apr 2017

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

Cost of 5,751 trades at $5 per Round Trip

= $28,755 (14.9 %)

Cumulative Profit - Cost of Trades =

$192,490- $28,755 = $163,735

==================================================

PMDT EMini Price Action Strategy- Mar 2017

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

traded by small traders and have the lowest cost E-mini margins.

Cost of 1,651 trades at $5 per Round Trip

= $8,255 (11.2 %)

= $8,255 (11.2 %)

Cumulative Profit - Cost of Trades =

$73,692 - $8,255 = $8,255

==================================================

PMDT EMini Price Action Strategy- Feb 2017

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

traded by small traders and have the lowest cost E-mini margins.

Cost of 3,439 trades at $5 per Round Trip

= $17,195 (12.8%)

Cumulative Profit - Cost of Trades =

$134,186 - $17,195 = $117,000

==================================================

PMDT EMini Price Action Strategy- Jan 2017

Each month the Simulator Account is reset to $7,500

The daily net profit from Ninja Trader's Account Performance is

entered in the Table below.

ES, NQ and YM are being traded because these instruments are commonly

traded by small traders and have the lowest cost E-mini margins.

traded by small traders and have the lowest cost E-mini margins.

Cost of 2,391 trades at $5 per Round Trip

= $11,955 (9.6 %)

Cumulative Profit - Cost of Trades =

$124,352 - $11,955 = $112,397